Recent College Grads: Create A Budget with These Easy Steps

Recent graduates have more reason than anyone to carefully manage their money, especially considering the rising costs of attending college. Luckily, there’s an abundance of information on creating a budget for recent college graduates available to us. We’ve prepared a simple list for those who don’t quite know where to start when it comes to managing their finances.

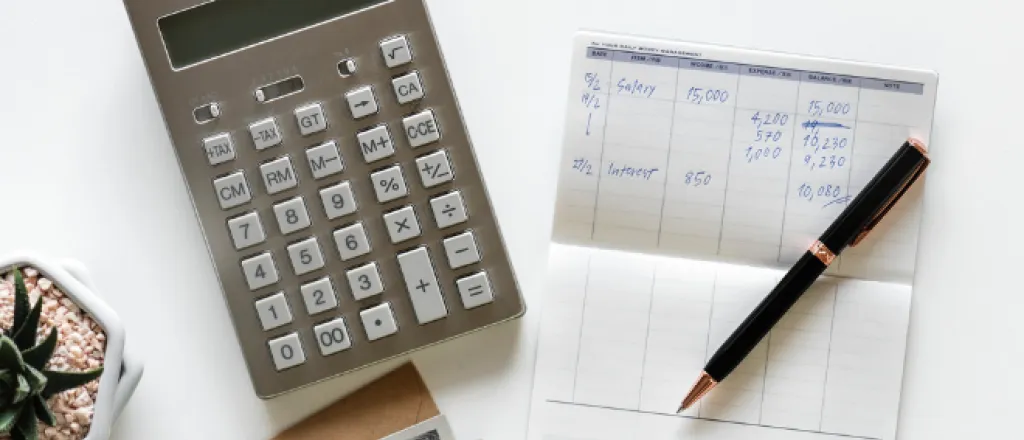

List Your Sources of Income

Hopefully, you’ve managed to secure a job right out of college—extra points if it’s in your field of study. The first thing we recommend doing is making note of exactly how much money you’re bringing in. Your budget should be based on all your sources of income, so include any side hustle you may have as well.

Make Note of New Expenses

In college towns, most students can walk, ride their bike, or use alternative modes of transportation to get around. However, for many people out of college, owning a car becomes a necessity. New expenses such as a new car lease and auto insurance will need to be taken into consideration when forming your budget. Depending on your situation upon graduation you may also health insurance and student loans you have to worry about as well.

Assess Your Lifestyle & Start Saving

Note all your non-negotiable expenses, such as rent, utilities, groceries, debt, etc. After the necessities are taken care of, you can start to account for inessential expenses—dining out, trips to amusement parks, and anything else you’d like to spend your money on. However you choose to spend your free time can be safely accounted for as long as you budget wisely.

Once you’ve noted these expenses, you can start to create a savings plan. Start with an amount you feel comfortable saving each month, and gradually increase the sum over time depending on your income. The benefits of starting your savings account early are totally worth it.

Establish A Line of Credit

Establishing credit is a crucial part of planning for the future. When it comes to buying a house or even landing an incredible job, you need credit. Establishing credit shows that you can be trusted to make payments on time and that you’re fiscally responsible. Start with a low limit and pay it off each month on time. Be aware of all the factors that affect your credit score like amounts owed, length of credit history, and payment history.

Creating a budget for recent college graduates may seem like a loud smoke alarm is constantly going off in your head. But, like with most things in life, if you have a plan of action, there’s really no need to panic!